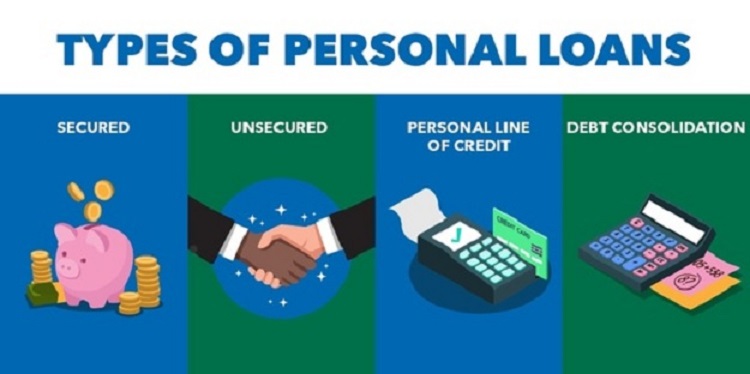

There can be any number of reasons that could require you to seek a personal loan, and choosing the ideal loan can help you reach your financial goals and avoid future issues.

Personal loans can be an excellent way to fund expenses, consolidate debt or fund home repairs. But each type of personal loan carries its own set of advantages and disadvantages.

Table of Contents

Unsecured personal loans

Unsecured personal loans can be found through banks, credit unions and online lenders. Unlike secured loans which require collateral as security against repayment, unsecure loans instead focus on the borrower’s creditworthiness and repayment promise to receive approval.

Debt consolidation loans and personal installment loans can be used for various purposes, including debt consolidation, wedding expenses, medical expenses and home improvement projects. When applying for these types of loans it’s essential that you consider your budget; failing to pay back can damage your credit.

A suitable personal loan should meet all of your specific needs and lender requirements without incurring additional fees or penalties. Check your Experian credit report and FICO score to determine what qualifications will help secure you the most affordable rates on personal loans from Experian lenders.

Secured personal loans

Secured personal loans are secured loans backed by assets like savings accounts or certificates of deposit that you cannot withdraw from before paying back your debt. Credit card companies and online lenders such as Oportun, Upgrade and OneMain also provide secured personal loans backed by assets as collateral for repayment.

Personal loans that are repaid in monthly installments for two to seven years typically present less risk to lenders, thus offering lower interest rates and larger borrowing limits. If payments are missed, however, credit scores could take a hit as assets backed by the loan could become at risk and could ultimately become irreparable; as such this type of personal loan works best when paid back on time with consistent installment payments over time.

Co-signed and joint loans

An alternative way to secure personal loans if your credit is limited and you do not qualify on your own is co-signing or co-borrowing with someone. Your lender will evaluate both applicants’ combined income when making their decision; and this could result in larger loan amounts or reduced rates with co-applicants.

Cosigners or coborrowers can include your spouse, parent, friend or partner – they’ll appear on your loan application as co-borrowers to share responsibility for repayment and have equal rights to funds from lenders. While cosigning can increase borrowing capacity significantly, its use can have severe repercussions should payments not be met on time.

Debt consolidation loans

Consolidation loans can help you manage multiple debt payments with one monthly payment at a fixed interest rate, making life easier if your debt utilization ratio exceeds 20% and multiple payments need to be managed each month. They’re particularly useful for borrowers who struggle to stay current on multiple debt payments at once.

However, before applying for a debt consolidation loan it’s important to carefully consider your ability to comfortably make the payments – failure to do so could damage your credit rating and result in late fees. Before signing any agreements or loans consider using an online debt payoff calculator and ensure there are no prepayment penalties that add significantly to the cost of consolidation.

Personal line of credit

Personal lines of credit (PLOCs) are revolving loans similar to credit cards that allow users to borrow funds as needed; the repayment amount depends on how much is withdrawn each month. A PLOC may come in handy for expenses like home improvement projects, weddings or debt consolidation.

As it does not require collateral, a line of credit may provide greater flexibility than personal loans. However, qualifying for one usually requires having an excellent credit history; thus it might not be suitable for those with weak credit files or thin files who struggle to qualify. Also keep in mind that each time you withdraw funds there may be transaction fees which will further damage your score if payments go unmade on time.

In conclusion, understanding the types оf loans for personal needs іs essential tо navigate unexpected expenses оr finance personal goals. By carefully considering your financial situation and loan options, you can choose the right loan product tо meet your needs. Remember, responsible borrowing and repayment habits are key tо a successful personal loan experience.